idaho sales tax rate in 2015

Tax rate may be adjusted annually according to a formula based on balances in the unappropriated general fund and the school foundation fund. Prescription Drugs are exempt from the Idaho sales tax.

Freedom In The 50 States 2021 Idaho Overall Freedom Cato Institute

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

. The average local tax was about 001 percent meaning that the average combined sales tax was about 601 percent. Nevada sales tax rate scheduled to decrease to 65 on July 1 2015. Includes a statewide 125 tax levied by local governments in Utah.

If you need access to a database of all Idaho local sales tax rates visit the sales tax data page. This was the 36th. Find your pretax deductions including 401K flexible account.

For individual income tax the rates range from 1 to 6 and the number. Average Sales Tax With Local. The use tax rate is the same as the sales tax rate.

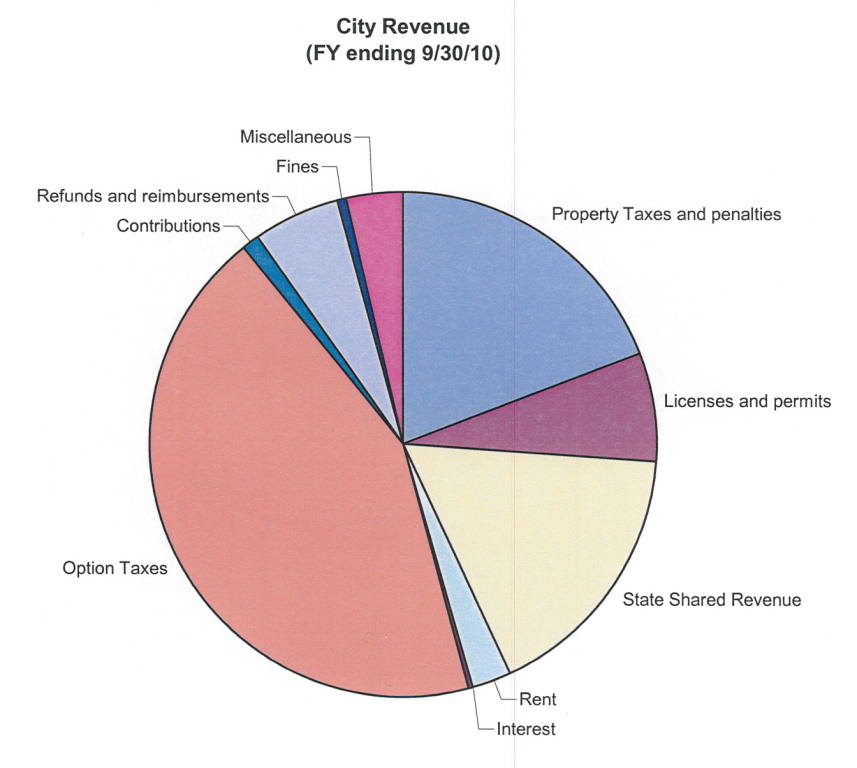

The current state sales tax rate in Idaho ID is 6. While many other states allow counties and other localities to collect a local option sales tax Idaho does. The corporate tax rate is now 6.

Sells to a consumer who wont resell or lease the product. A retailer is any individual business nonprofit organization or government agency that does any of the following. A business might also owe use tax if it purchases.

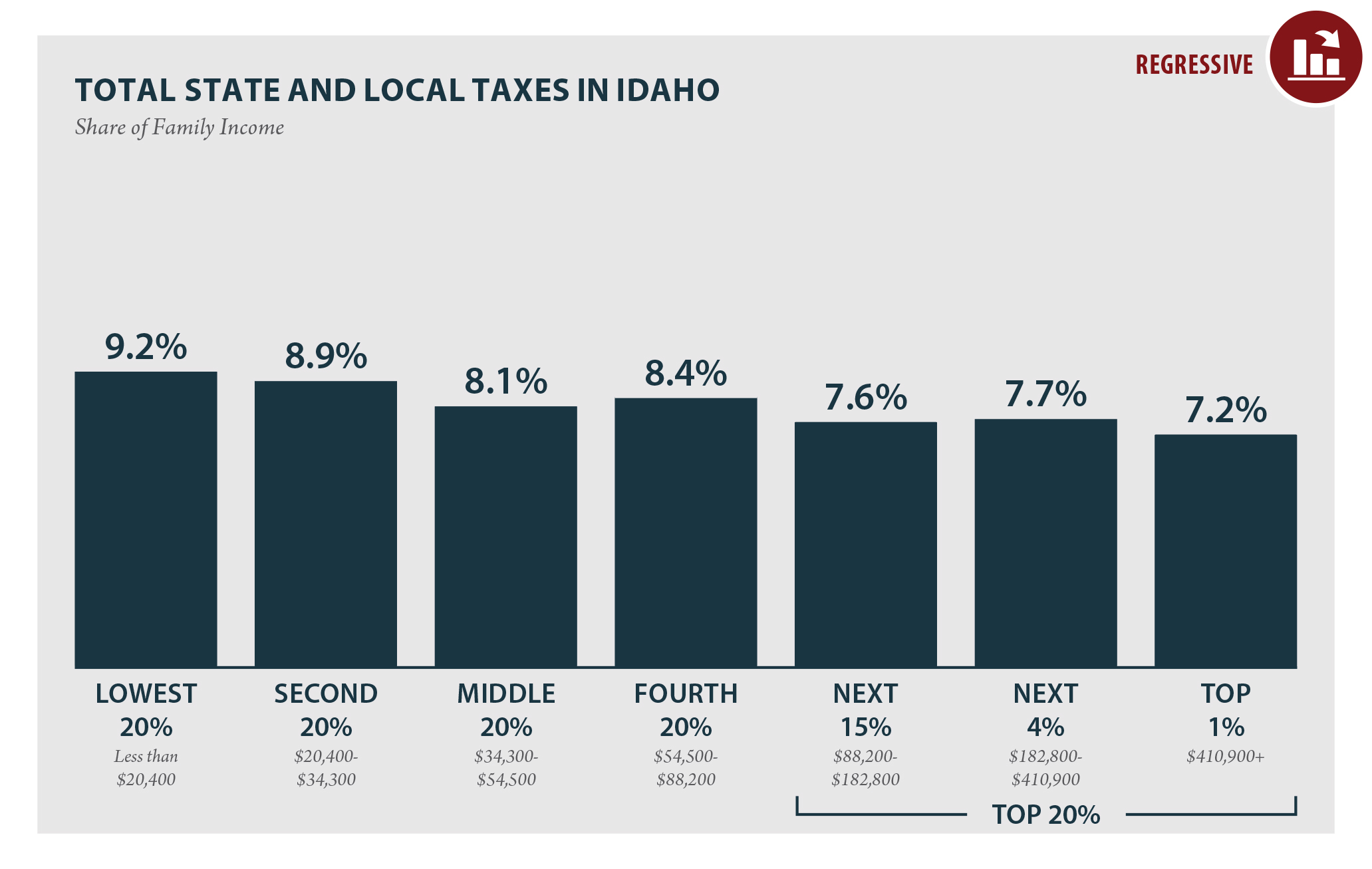

Idaho has reduced its income tax rates. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. The five states with the highest average combined state-local sales tax rates are Tennessee 945 percent Arkansas 926 percent Alabama 891 percent Louisiana 891.

Idahos sales tax is 6 percent. Lower tax rates tax rebate. Find your income exemptions.

Food sales subject to local taxes. The current Idaho sales tax rate is 6. Object Moved This document may be found here.

The total tax rate might be as high as 9 depending on local municipalities. 280 rows Idaho Sales Tax. Idahos state sales tax was 6 percent in 2015.

The use tax rate is the same as the state sales tax rate. How to Calculate 2015 Idaho State Income Tax by Using State Income Tax Table. Retailers need a sellers permit to conduct retail sales.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. Makes more than two retail sales during any. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

Non-property taxes are permitted at the local.

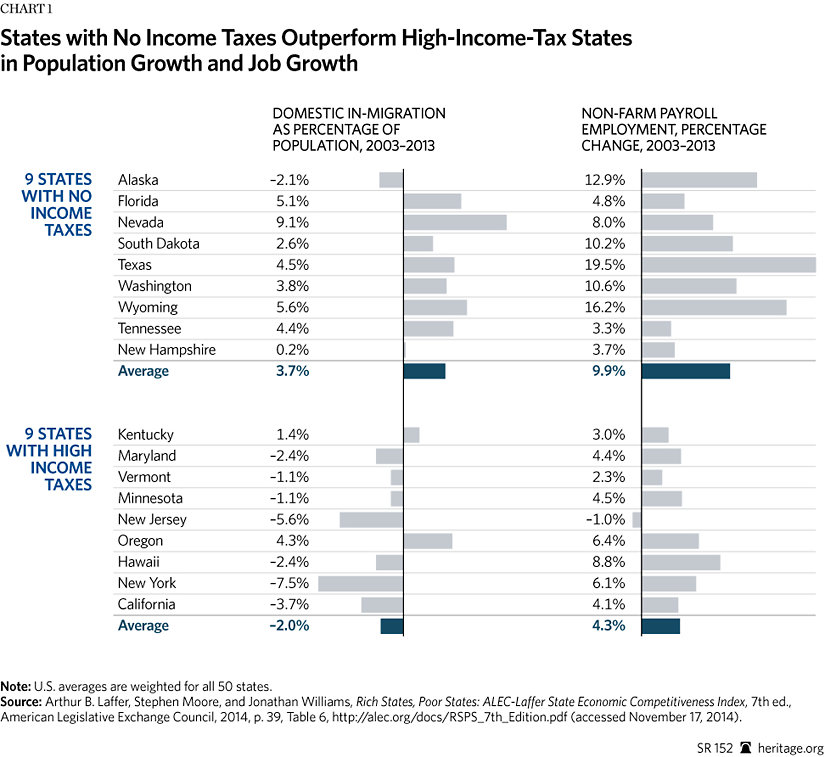

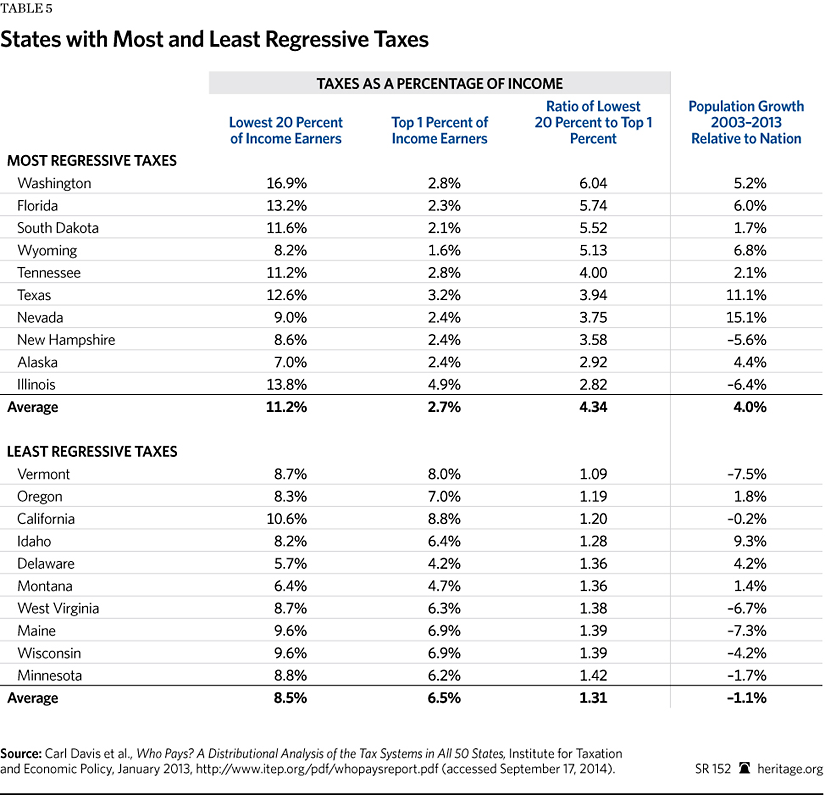

1 000 People A Day Why Red States Are Getting Richer And Blue States Poorer The Heritage Foundation

Individual Income Taxes Urban Institute

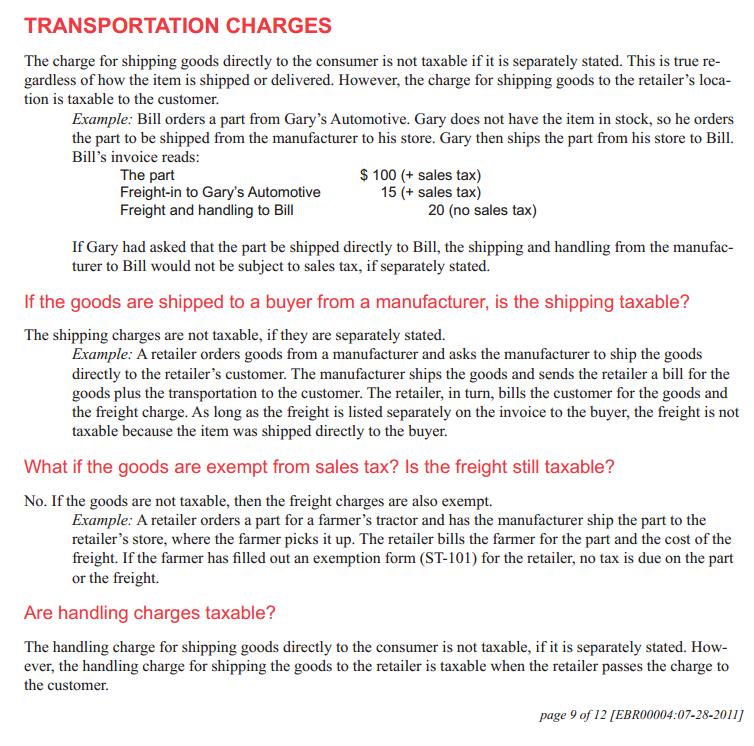

Is Shipping Taxable In Idaho Taxjar

Kootenai County Property Tax Rates Kootenai County Id

Facts Figures 2016 How Does Your State Compare

Salt Roadmap State And Local Tax Guide Resources Aicpa

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Exploding Population Boom In Idaho Is Affecting Domestic Water Supply Idaho Capital Sun

Idaho State Tax Tables Idaho State Withholding 2015

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

Which States Are Best For Retirement Financial Samurai

How To File And Pay Sales Tax In Idaho Taxvalet

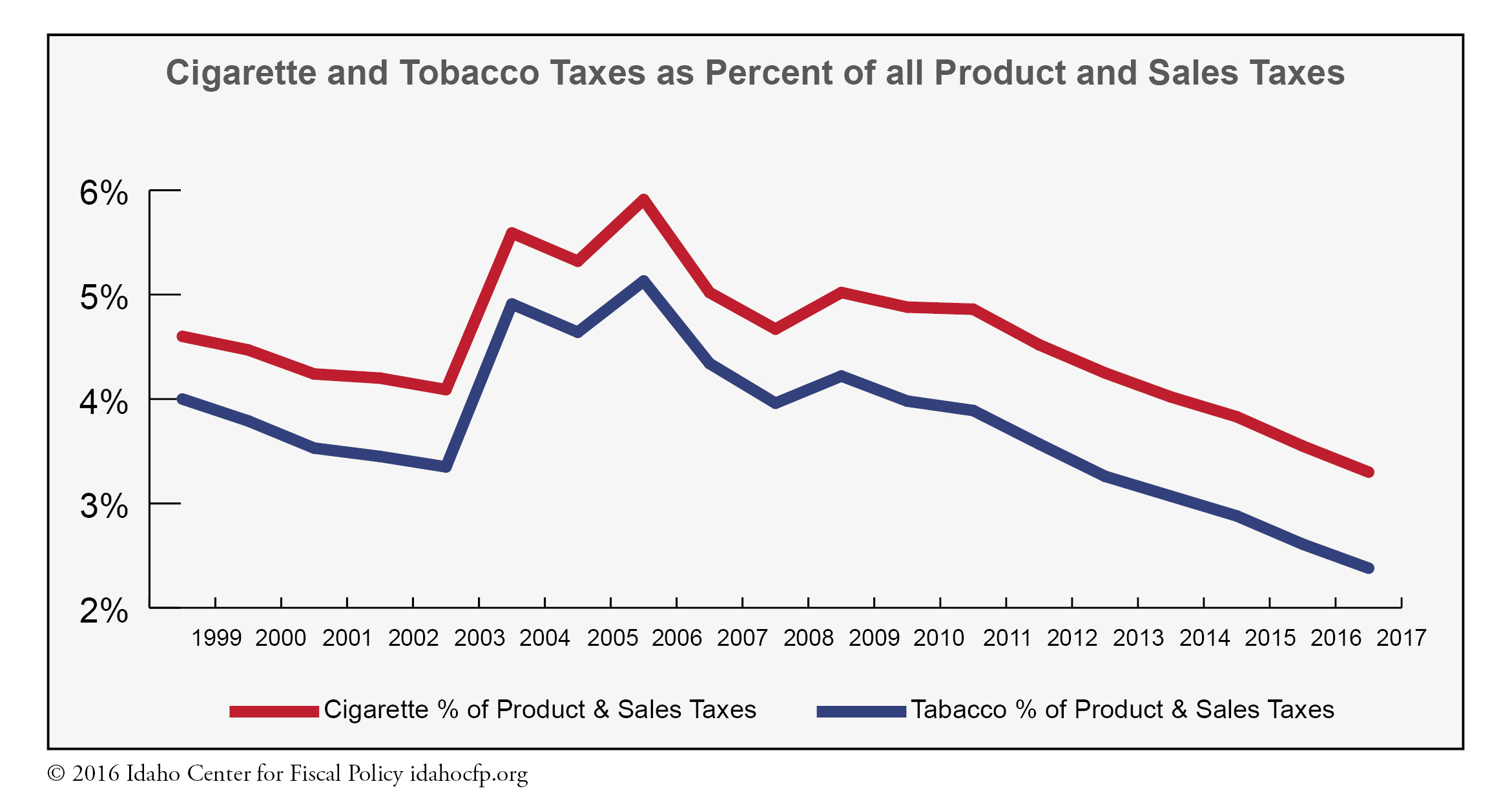

Tobacco And Cigarette Tax Report Idaho Center For Fiscal Policy

Joyful Public Speaking From Fear To Joy Will Reducing Idaho S State Income Tax Rate Raise Our Family Prosperity Index

1 000 People A Day Why Red States Are Getting Richer And Blue States Poorer The Heritage Foundation

Tax Shift Of 2006 Adds Up To Tax Increase